If there are damages after an accident, the injured party can file a Atlanta personal injury claim against the at-fault person. But what if that accident happens at work? If you were injured while performing work duties, the insurance process is a little different.

Let’s review how a workplace incident affects your insurance and how to handle a claim.

When the Accident Happens in a Company Vehicle

If you are driving a company car or truck for work and you are at fault in an accident, the damages should be covered by your employer’s insurance policy.

This is known as vicarious liability. It refers to the employer being held liable for negligent actions by their employees. Vicarious liability gives an accident victim the right to sue your employer for damages instead of you. The insurance protects you from getting involved in a lawsuit. The majority of Georgia businesses are covered under vicarious liability.

If an accident happens while you’re on the clock, your employer will report the accident to their insurance policy. If the employer’s insurance covers the damage, you won’t need to notify your auto insurance provider about the accident.

That said, if the responding officer wrote an accident report that included your information, the accident can show up on your driving record. In addition, if you change to a new insurance policy within three years of the incident, it can show up on your record and affect your new policy rates.

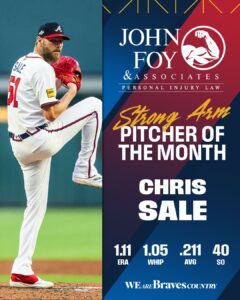

Get the strong arm

When the Accident Occurs in a Personal Vehicle

If you are in your vehicle when an accident occurs, the lines are a little blurry. If you drive your own vehicle while on the clock and cause an accident, it should fall under vicarious liability. However, your employer will still be responsible for any damages. This can apply even if you are performing work duties off-premises.

Situations Where Your Own Insurance Could Apply

There are some circumstances where an employer is not liable for accident damages, and, therefore, your own insurance is responsible. For example, your insurance policy may be liable if you:

- Stop in the middle of your work duties to run a personal errand

- Were acting outside of your scope or employment

- Are off the clock or driving to or from work

- You are an Uber or Lyft driver but not carrying a passenger

- Were violating company rules or acting recklessly at the time of the accident

In these situations, your employer’s insurance may still be liable if they failed to properly screen, train, and supervise employees. If your employer claims that you are responsible for damages during work hours, it’s best to contact a personal injury lawyer. They can help you sort out the details and make sure the claims are lawful.

Injury Coverage After a Work Accident

The above examples refer to accidents that cause injuries to other people. But what if you are injured during an accident while at work?

If you suffered an injury at work, such as getting harmed by equipment or driving a vehicle to perform your job duties, that would fall under a workers compensation claim. To be eligible for workers comp insurance, you must sustain a physical injury while performing job duties.

In accordance with Georgia’s workers’ compensation law, an employer must carry a workers’ comp policy if they have three or more employees (including the business’s owner).

After a Work Accident, File a Workers’ Compensation Claim

Most of the time, if an accident occurs at work, your employer’s workman’s comp policy should cover the damages. Workers’ compensation insurance provides financial recovery to employees who suffer injuries while on the job. It protects business owners from expensive damages and ensures injuries employees receive fair compensation for their damages.

In Georgia, workers compensation can cover damages like:

- Costs of doctor visits and all medical treatment for your injuries

- Prescription medications

- Physical therapy or rehabilitation

- Temporary or total disability benefits

- Travel to and from medical appointments

Filing a workers’ compensation can be tricky. If you were in an accident while working and aren’t sure how to proceed, contact a workers compensation lawyer to go over the details.

Georgia Workers’ Compensation Statute of Limitations

In Georgia, a worker must file a workers’ compensation claim within one year of the accident date. This is different from other personal injury claims, which have a two-year statute of limitations.

To ensure you file your claim on time, pattern with a Georgia workers’ compensation lawyer. Our legal experts are well-versed in Georgia laws and will get your claim taken care of quickly.

Contact a Georgia Workers’ Compensation Lawyer Now

At John Foy & Associates, we always offer a free initial consultation so you can learn the best options for your case. With more than 20 years of experience in workman’s comp cases, we can advise you on the best course of action. Give us a call or fill out the online form on this page to get started.

(404) 400-4000 or complete a Free Case Evaluation form